As a financial advisor, you know that market declines are a normal part of investing. But when it actually happens, your clients will inevitably get nervous, feel a knot in their stomach, and want to hear from you immediately.

It’s your job to talk them off the ledge by keeping them calm and informed during volatility. But what’s the best way to communicate about recent market events? And can you take advantage of the volatility as a marketing opportunity? Turns out, the answer is yes.

Whether it’s a small dip or a full-blown financial crisis like we saw in 2008 and 2020, market volatility is a powerful marketing opportunity you shouldn’t let go to waste.

Here’s why:

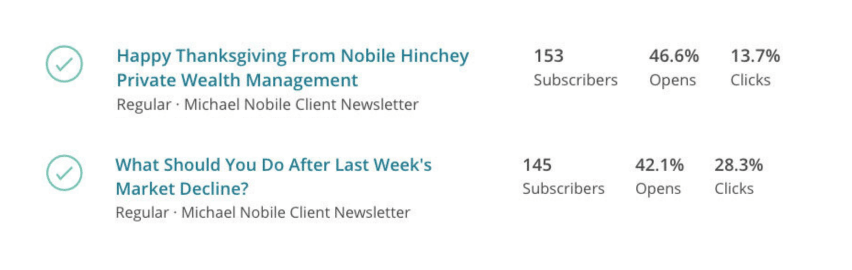

First, your campaign about volatility is likely to get twice as many views and shares as your other campaigns, as we can see in this example:

Second, prospects have unprecedented urgency to act during an uncomfortable market dip. Yet very few advisors have a plan ready in advance to address a downturn.

Why You Need to Communicate During Volatility

Proactive communication is good client service. Your clients hire you to not only help plan for their financial future, but to educate them in good times and in bad. They are eager to hear from you to get an explanation of what’s going on and receive some guidance on what they should (or shouldn’t) do about it.

It’s your job to keep clients from selling when the market is down. We all know that behavior is an important component to long-term investment success, and when clients are feeling the urge to sell when the market is low, it’s your place to remind them of their long-term plan.

Staying in touch results in fewer phone calls and panicked clients. If you’re able to act quickly, clients are more likely to trust that you’re prepared for the volatility and they’ll feel they’re in good hands. This results in less time spent educating and calming individual skittish clients.

What Should You Say About a Correction?

Most financial advisors wait too long to communicate during market downturns because they know that each event is different and they’re waiting to fill in the specifics. And we know that the markets may correct after a big decline.

However, no matter the cause of the market drop, your key messaging will be the same. You’ll want to communicate the following key points to clients:

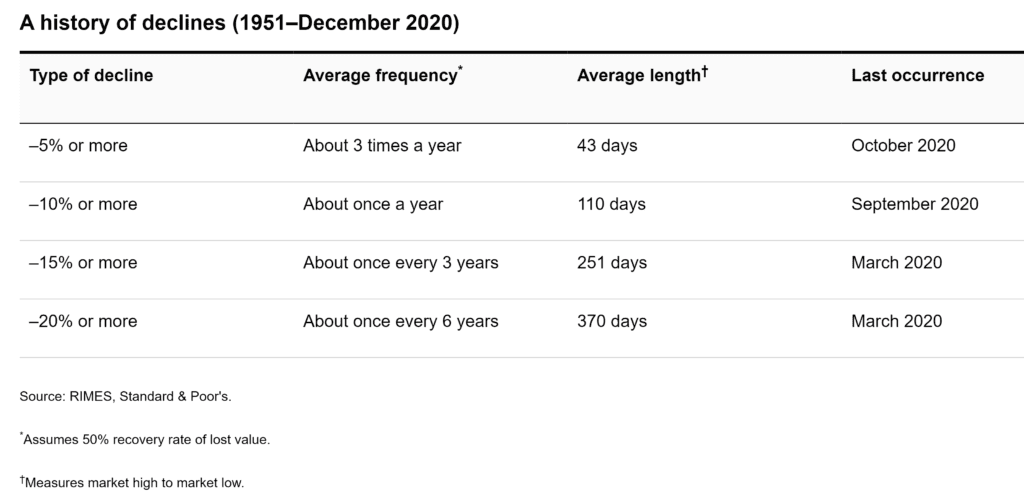

This is expected. Explain that you have been anticipating volatility and that it’s a normal and healthy part of market cycles. Point to historical data that shows the frequency of similar events. (1)

Their portfolio is not down as much as the market. Remind your clients that while the S&P 500 may be down X% percent, their accounts are not invested in the index and have therefore declined less than the market. Urge them to call you if they have questions about their individual accounts.

Now is not the time to sell. Explain that no one can consistently predict the right time to get in or out of the market. It’s human nature to lose patience and sell at or near the bottom of a downturn. Even if you were able to get out early in a decline, you’d still have to guess when to get back into the market, and you’d likely guess wrong.

They have not realized any losses yet. It’s normal to feel uncomfortable when the market is down, especially if you’re approaching retirement. However, each time in history that the market has gone down, it has come back up again. Average downturns of 10% are likely to return to normal within about 110 days, based on historical data.

Stay focused on the long term. Remind clients that you’ve built their financial plan and investment strategy for the long term, with short-term volatility in mind. While a correction can be upsetting, there’s no reason to deviate from their long-term financial plan.

Call if they have questions. Encourage clients to get in touch if they are feeling nervous or want to review their accounts.

How to Use a Correction to Get Referrals

Now that you’ve proactively communicated with your existing clients, it’s time to use the market downturn as an opportunity. The Red Cross is always at the ready to deploy fundraising campaigns as soon as a disaster strikes. This doesn’t make them greedy; it simply allows them to strike while the iron is hot so they have the funds for the following disaster.

Downturns bring precious urgency in prospects that we don’t find at any other time. In marketing, our archnemesis is a lack of urgency. Folks who have put off financial planning for most of their lives are not easily pushed into action when times are good. But when times are bad, things get very uncomfortable and they’re more willing to talk. Here’s how to go after referrals when times are bad:

Include a deal for your clients’ friends and family. Offer to provide a complimentary second opinion and recommendations to minimize losses.

Provide an easy action to take. Share a link to schedule a 15-minute investment review by phone. This way, even if prospects read your email after hours, they can take action when they’re feeling peak urgency and sleep better that night.

Remind clients that you are never too busy to help the people they care about. Reiterate that if they have friends, family, or coworkers who are nervous about the market volatility, you are here to help. Encourage them to forward your market update email to their network.

Bring up outside accounts. Make a point to mention to clients that while the accounts you manage are prepared for this correction, now is a good time to review old 401(k)s and other assets you do not currently manage to assess risk.

Want to learn more about how to market during a crisis? Watch this free webinar where we’ll teach you how to multiply your best clients and help more people during the coronavirus pandemic.

Get Your Free Customizable Template

We created a free article template you can send out to clients on “What Should You Do About Inflation and Stock Market Volatility?” Download your free template here to prepare for the next correction. Be sure to get it approved by compliance before sending.

Looking for more ways to improve your marketing as a financial advisor? Find more information on our blog. And for weekly marketing tips by video, subscribe to our YouTube channel here:

https://www.youtube.com/c/IndigoMarketingAgency. Or learn more about how we help financial advisors just like you grow their businesses with our Total Marketing Package.

_____________

(1) https://www.capitalgroup.com/individual/planning/market-fluctuations/past-market-declines.html