What You Need To Know About The Financial Advisor Landscape

Wondering what 2025 holds for financial advisors? Here at Indigo Marketing, we’re right there with you—looking ahead! That’s why we wanted to give you a sneak peek into what the financial advisor landscape may look like next year. Let’s start with the most current trends.

What The Statistics Say

According to the Bureau of Labor Statistics, there are approximately 272,190 financial advisors in the United States—down from 2022. While data surrounding how many people actually use financial advisors is scarce, one recent survey suggested that only 9% of the survey’s respondents use a human financial advisor to manage their portfolio. Keep in mind this statistic doesn’t reflect whether these individuals also seek other types of financial advice from their advisors.

According to the Bureau of Labor Statistics, the median pay for financial advisors is $99,580 per year, with the average salary being approximately $150,670 per year. Various research and reports indicate that the average age of financial advisors ranges from 51 to 56.

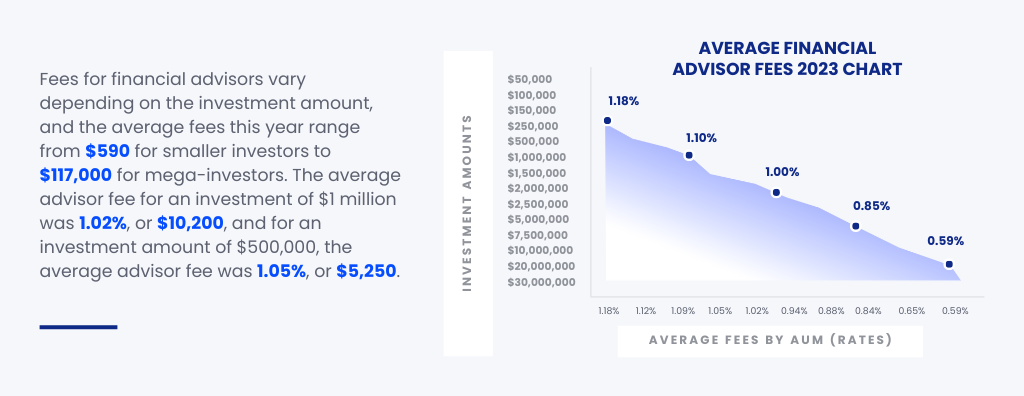

As you know, fees for financial advisors vary depending on the investment amount, and the average fees last year ranged from $590 for smaller investors to $177,000 for investors with over $30 million. The average advisor fee for an investment of $1 million was 1.02%, or $10,200. For an investment amount of $500,000, the average advisor fee was 1.05%, or $5,250.

Shifting Generations

As Baby Boomers continue to retire, financial advisors across the country have started targeting the younger generations (Generation X and Millennials) to varying degrees of success.

This strategy makes perfect sense. After all, the latest U.S. Census Bureau data shows these two generations now make up more than 42% of the U.S. population. Interestingly, nearly 80% of them also turn to social media for advice, opening up a big opportunity for financial advisors to engage.

In any case, the next decade will be critical for financial advisors to connect with younger generations as Baby Boomers shift from saving to spending their assets and interest from newer clients continues to wane.

What’s more, the U.S. Bureau of Labor Statistics predicts that the financial advisor profession will continue to grow at an above-average pace. It’s projected that 42,000 new financial advisor roles will be created from 2022 to 2032, raising the total from 227,600 (in 2022) to 369,600 by the end of the decade—a 13% growth! This expansion is approximately four times the expected 3% rise in overall employment across all professions during the same time frame.

According to FINRA’s most recent report, there were 3,298 securities firms at the start of this year. Meanwhile, the most recent data suggests there are approximately 15,114 Registered Investment Advisors (RIAs) employed in the United States.

The Top In The Industry

As of mid-year, the top four broker-dealers by AUM include Charles Schwab, Vanguard, Fidelity Investments, and JPMorgan Chase & Co.

According to Barron’s, the top five registered investment advisors (RIAs) include Edelman, Hightower Advisors, Creative Planning, Mariner Wealth Advisors, and Wealth Enhancement Advisory Services. Edelman serves just 1.3 million clients and has a team of 421 financial advisors. Hightower boasts 46,156 clients and 344 advisors. Creative Planning has 67,338 clients and 541 financial advisors. Mariner Wealth Advisors has 625 advisors serving 79,767 clients. Wealth Enhancement serves 50,761 clients with a total of 412 financial advisors.

Are You Ready For The Future?

After all the uncertainty of the last few years, it’s refreshing to have confidence that the financial advisor landscape looks bright for 2025 and beyond.

If you’re feeling frustrated by ineffective marketing efforts, Indigo’s Total Marketing Package for financial advisors offers three tiers to streamline your strategy, save time, and deliver high-quality leads and referrals. Our expert team will manage your messaging and implement your strategy, freeing you to focus on clients.

Compare the three tiers of our done-for-you marketing solutions that make it even easier to stay top-of-mind, grow your business, and maximize ROI with any budget.

If you have any questions about your marketing strategy for 2025, schedule a free strategy session with our team. We’d love to help you create a customized marketing plan that attracts your ideal client and keeps your business growing for decades.

Schedule Your Free Marketing Strategy Call Today

Check Out Our Related Video Content

Whether you’re a beginner or looking to improve your existing video marketing efforts, this webinar is designed to provide actionable insights and practical tips to make your videos a success.

At Indigo Marketing Agency, we help financial advisors embrace the evolving marketing landscape by utilizing custom video content. Read on for three reasons why you should incorporate video into your marketing strategy and how the Indigo team can help.

Connecting with your clients is of the utmost importance. But it can be really challenging in today’s digital age with all the noise. How are you supposed to stand out from the crowd?

FAQs

According to the Bureau of Labor Statistics, there are approximately 272,190 financial advisors in the United States. The median pay for financial advisors is $99,580 per year, with the average salary being around $150,670 per year. The average age of financial advisors ranges from 51 to 56.

Fees for financial advisors vary based on the investment amount. In 2022, the average advisor fee for an investment of $1 million was 1.02%, or $10,200. For an investment amount of $500,000, the average fee was 1.05%, or $5,250. Fees can range from $590 for smaller investors to $177,000 for investors with over $30 million.

The financial advisor profession is projected to grow at an above-average pace. The U.S. Bureau of Labor Statistics predicts 42,000 new financial advisor roles will be created from 2022 to 2032, raising the total to 369,600 by the end of the decade—a 13% growth. This expansion is approximately four times the expected 3% rise in overall employment across all professions during the same period.

As Baby Boomers retire, financial advisors need to connect with younger generations (Generation X and Millennials) to sustain their client base. These generations now make up over 42% of the U.S. population and heavily rely on social media for advice. Financial advisors can effectively target these groups by engaging with them on social media platforms and offering relevant content that addresses their financial needs and preferences.

As of mid-year, the top four broker-dealers by AUM are Charles Schwab, Vanguard, Fidelity Investments, and JPMorgan Chase & Co. The top five registered investment advisors (RIAs), according to Barron’s, are Edelman, Hightower Advisors, Creative Planning, Mariner Wealth Advisors, and Wealth Enhancement Advisory Services. Edelman serves 1.3 million clients with 421 advisors, Hightower has 46,156 clients with 344 advisors, Creative Planning has 67,338 clients with 541 advisors, Mariner Wealth Advisors has 625 advisors serving 79,767 clients, and Wealth Enhancement serves 50,761 clients with 412 advisors.